17 Seconds #105. Useful Info Quickly.

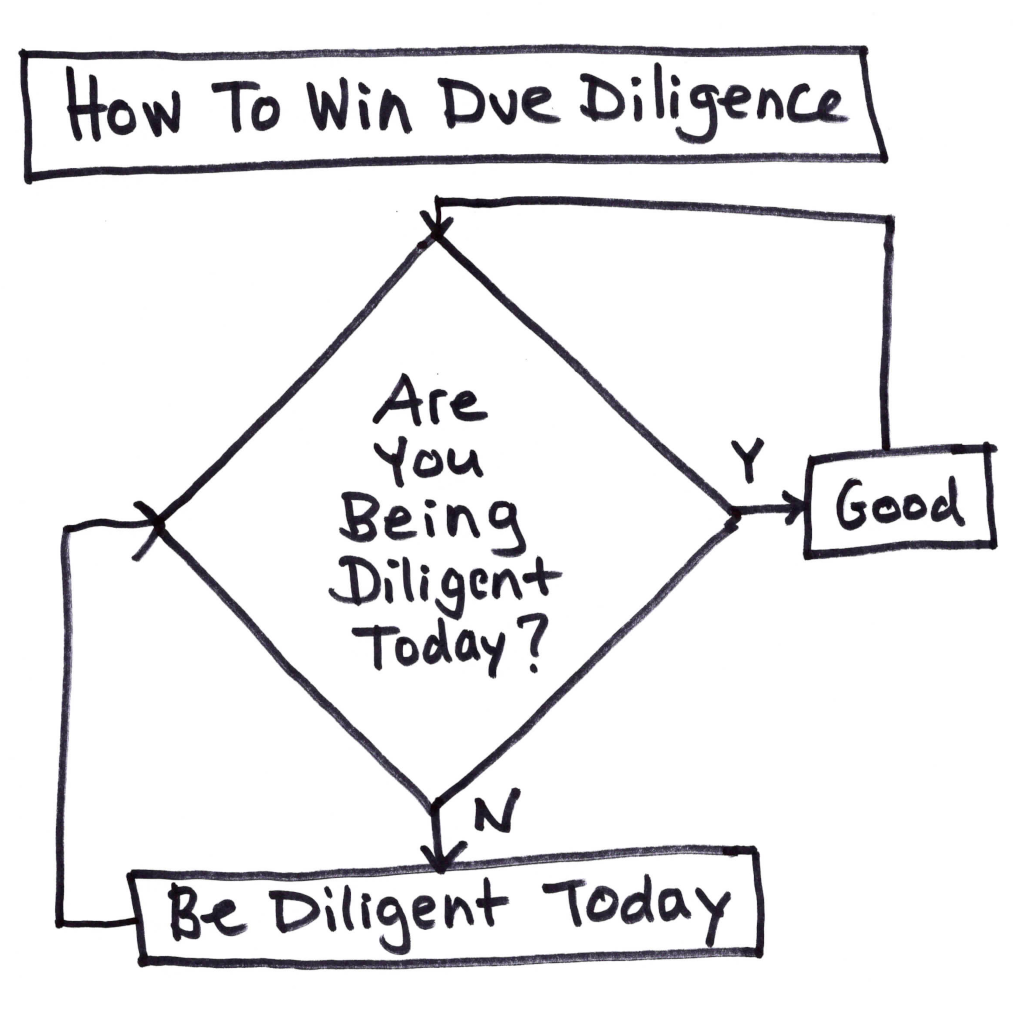

The tl;dr version is that startups should be diligent today to make IP due diligence go smoothly tomorrow.

Don’t take shortcuts today, it will only burn you tomorrow. A legendary NCAA basketball coach said it better:

“If you don’t have time to do it right, when will you have time to do it over?”

– John Wooden

I’ve done hundreds of due diligence exercises in the three overlapping acts of my career:

- Act 1 = Doing #startups as a founder/co-founder/employee ($6B in exits).

- Act 2 = Clocktower = #Patents and #Trademarks for #Startups (another $6B in exits).

- Act 3 = Helping the #givers in the #startup community avoid the toxic #takers (Treehouse and #RIFKIN).

Most of the companies that Clocktower represents are angel- or VC-backed startups on a 5-to-8-year exit trajectory. And due diligence also happens in conjunction with financing rounds, which is another reason to do IP diligently today.

After all, when startups get acquired, the vast majority of their assets are intangible, and intangible assets are best protected by a solid IP strategy. It’s not like the acquirer is buying widgets. And even if they are buying widgets, the value of widgets is in the intangible method of making the widgets!

17 Seconds is a publication for clients and other VIPs. Powered by Mailchimp and the beat of a different keyboard player. Click here to subscribe to 17 Seconds.